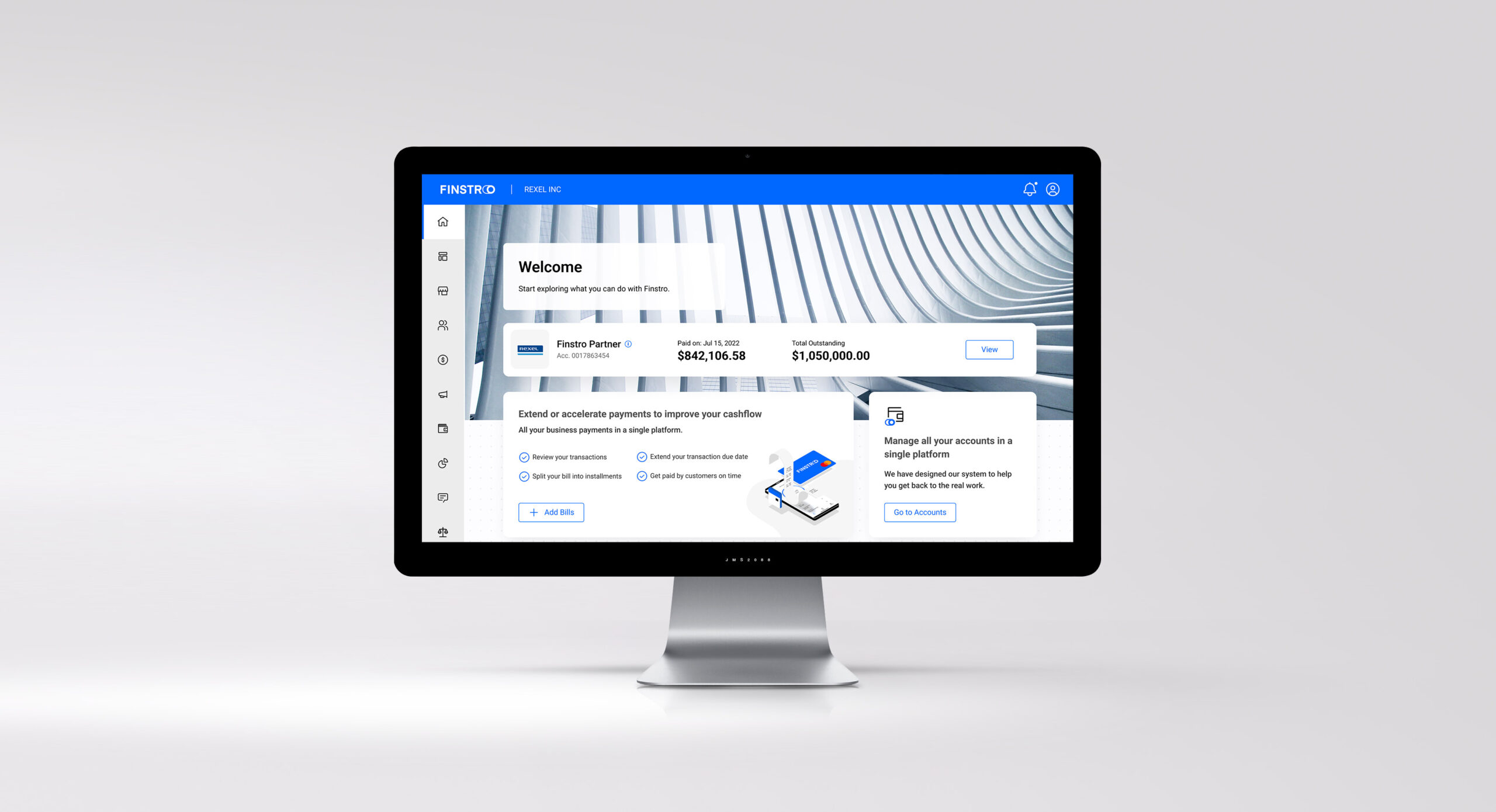

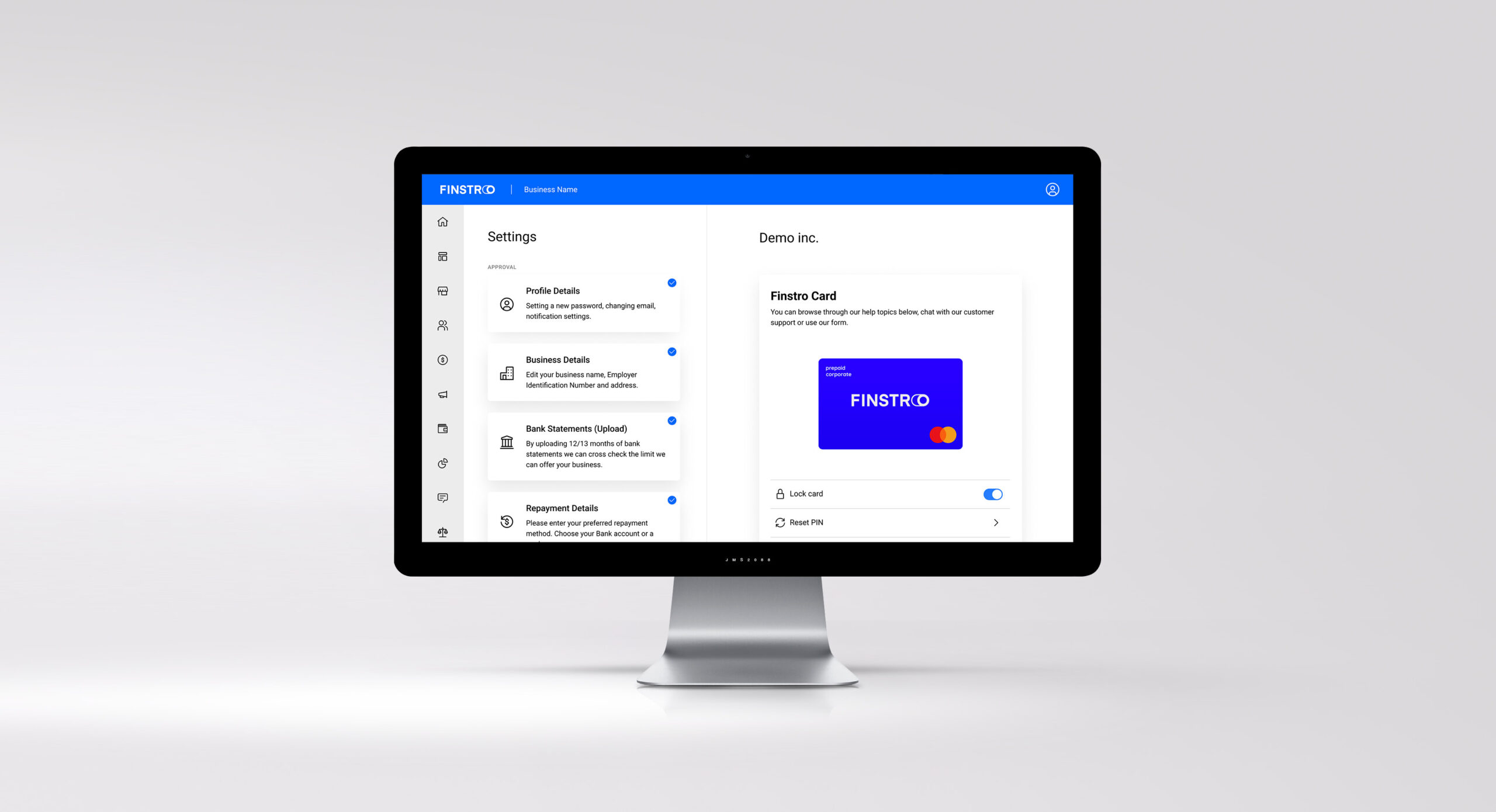

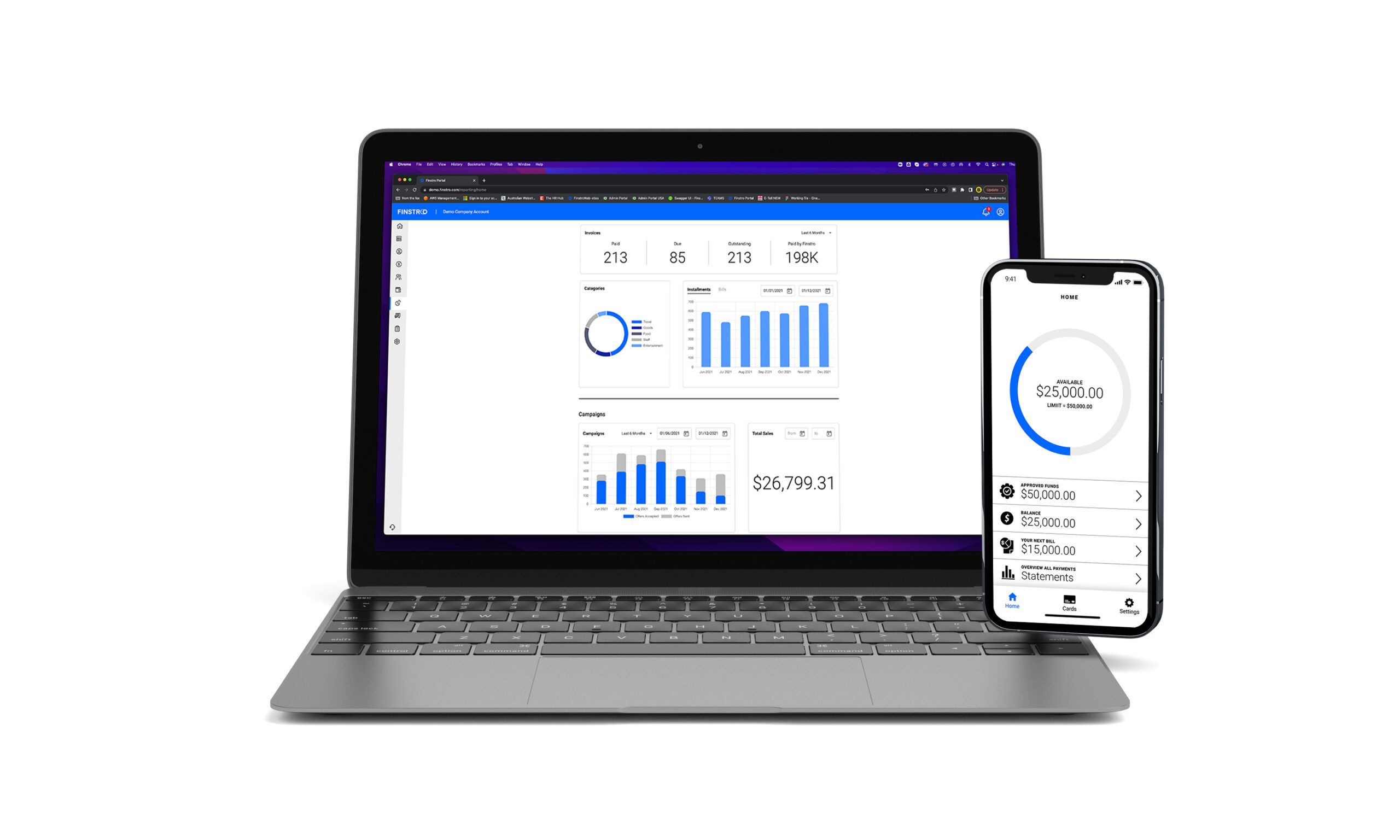

Brandlab collaborated with a forward-thinking client to design and implement a robust SaaS platform that seamlessly integrated back-office and front-office functionalities, along with advanced features like digital wallets, card issuance, and account-to-account (A2A) transactions built to banking standards. This transformative project aimed to revolutionize how businesses manage their operations, enhance customer interactions, and improve financial transaction efficiencies.

Services

Client

Year

Website

Challenge

Effective cash flow management is a cornerstone of financial success for both individuals and businesses. Developing a cash flow management system with the same standard and quality as a bank is a monumental task, especially when managing over $4.2 billion in assets. This case study outlines the end-to-end journey of building such a system over five years, involving a team of over 300 experts, and achieving SOC2 and SOC3 compliance.

The client required a comprehensive cash flow management system that could:

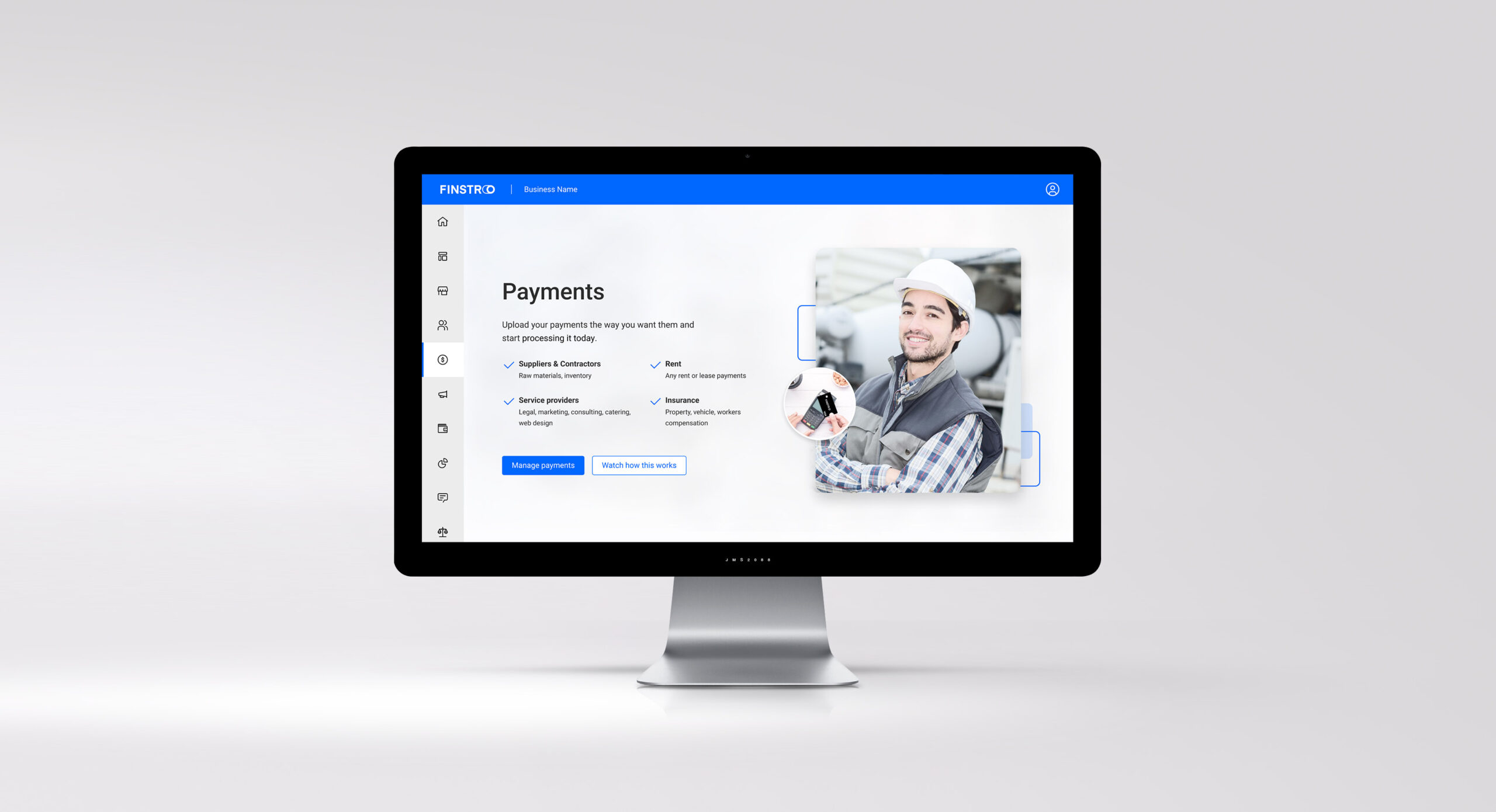

Manage Diverse Financial Products: Handle accounts, cards, credit, debt, and payments seamlessly.

Support Large-Scale Transactions: Process millions of transactions daily with precision and reliability.

Ensure Robust Security: Protect sensitive financial data with top-tier security measures.

Achieve Regulatory Compliance: Meet SOC2 and SOC3 standards for operational integrity.

Deliver Scalability: Support over $4.2 billion in assets under management.

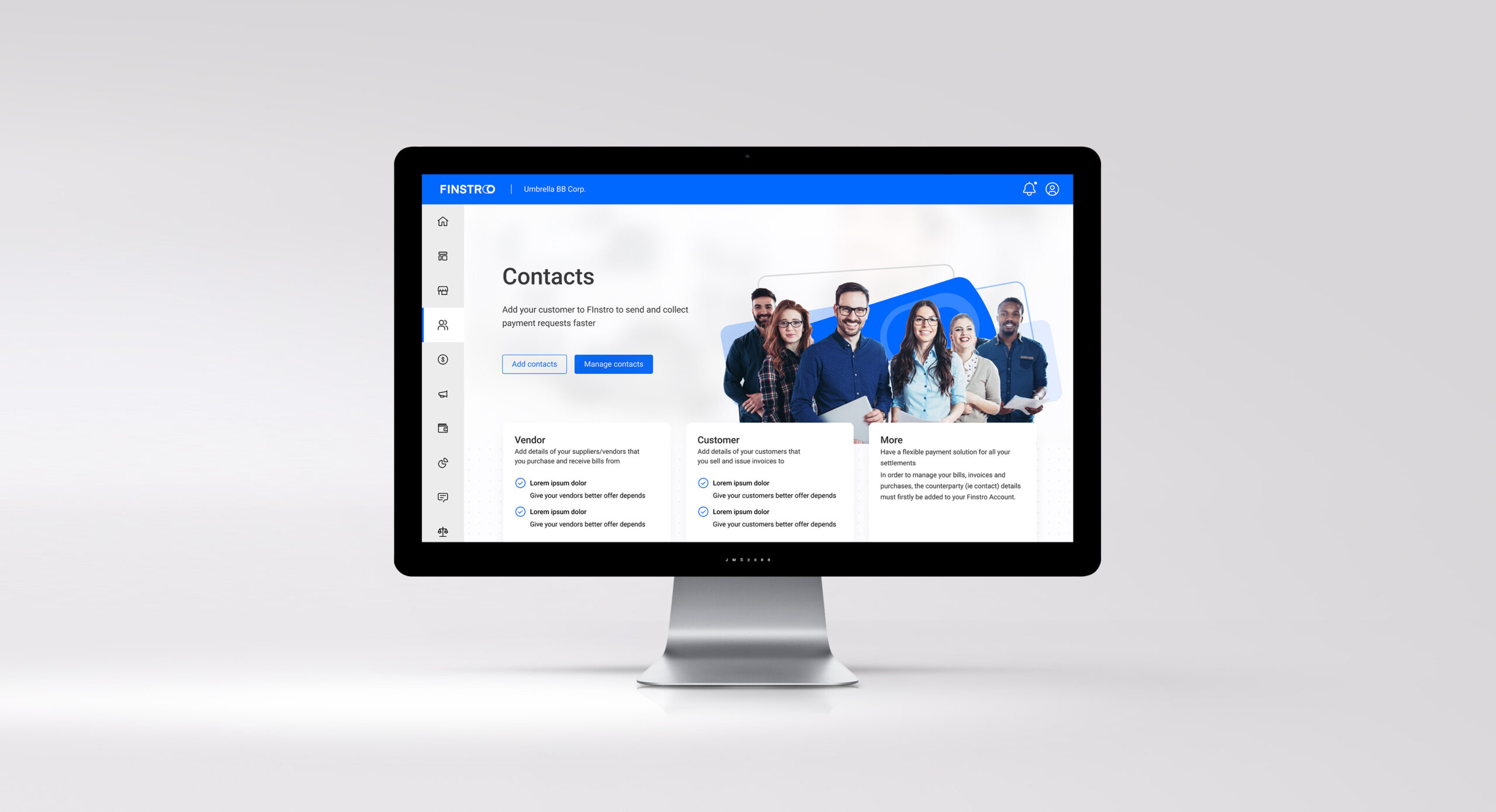

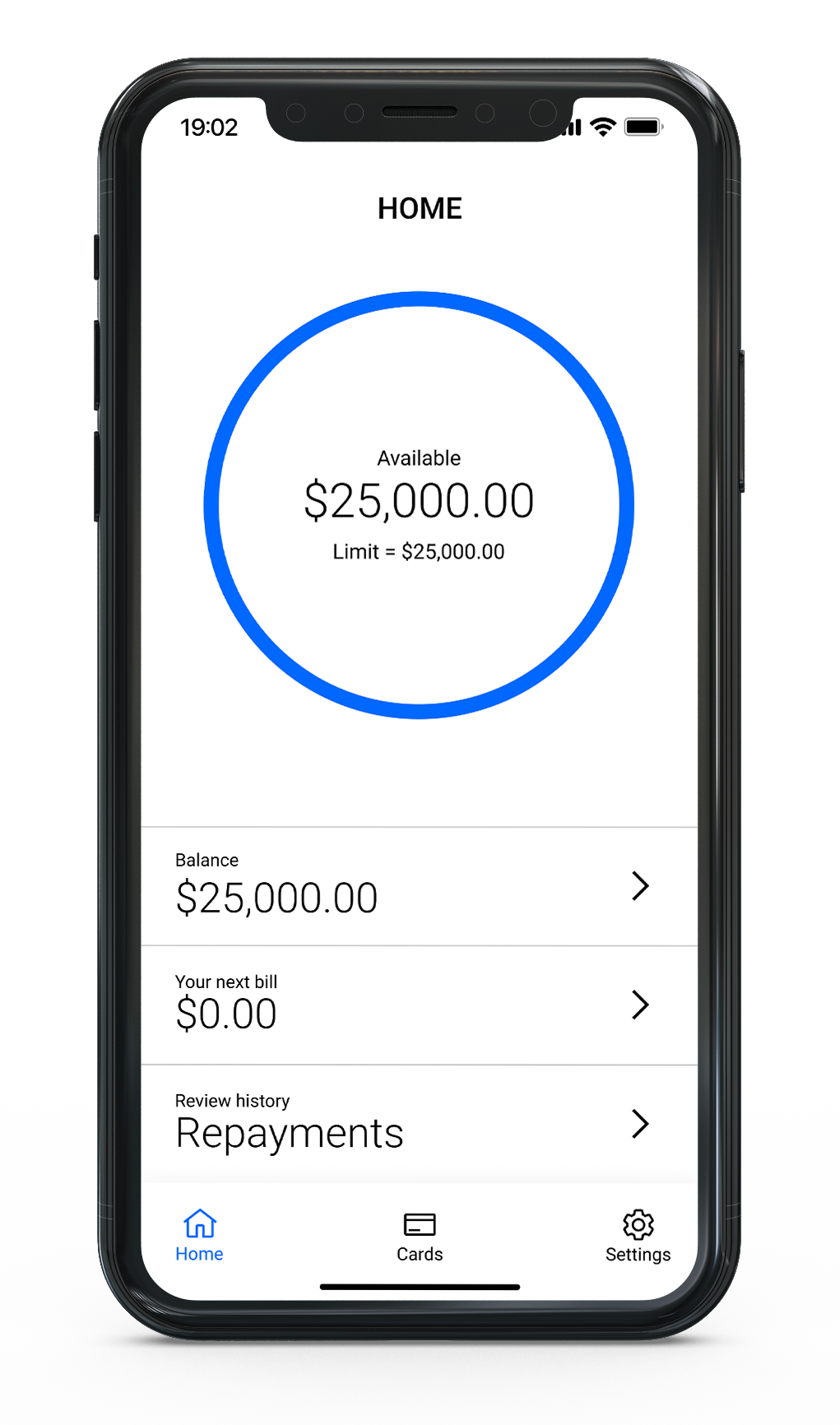

Provide User-Centric Design: Offer intuitive interfaces for businesses and individual users.

Goal

We did some intense market research, refined their brand message, and created a brand new look to truly showcase their identity.

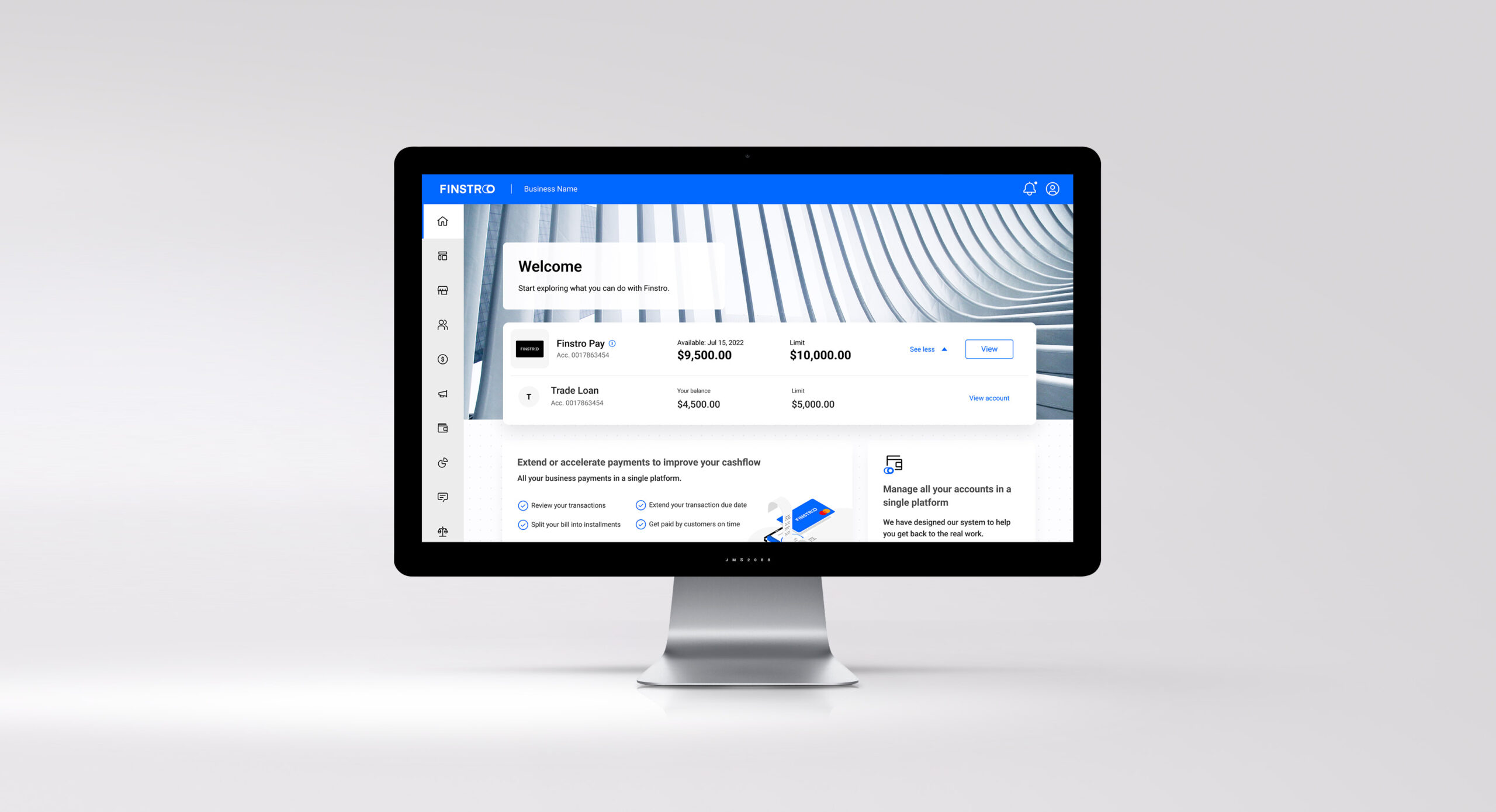

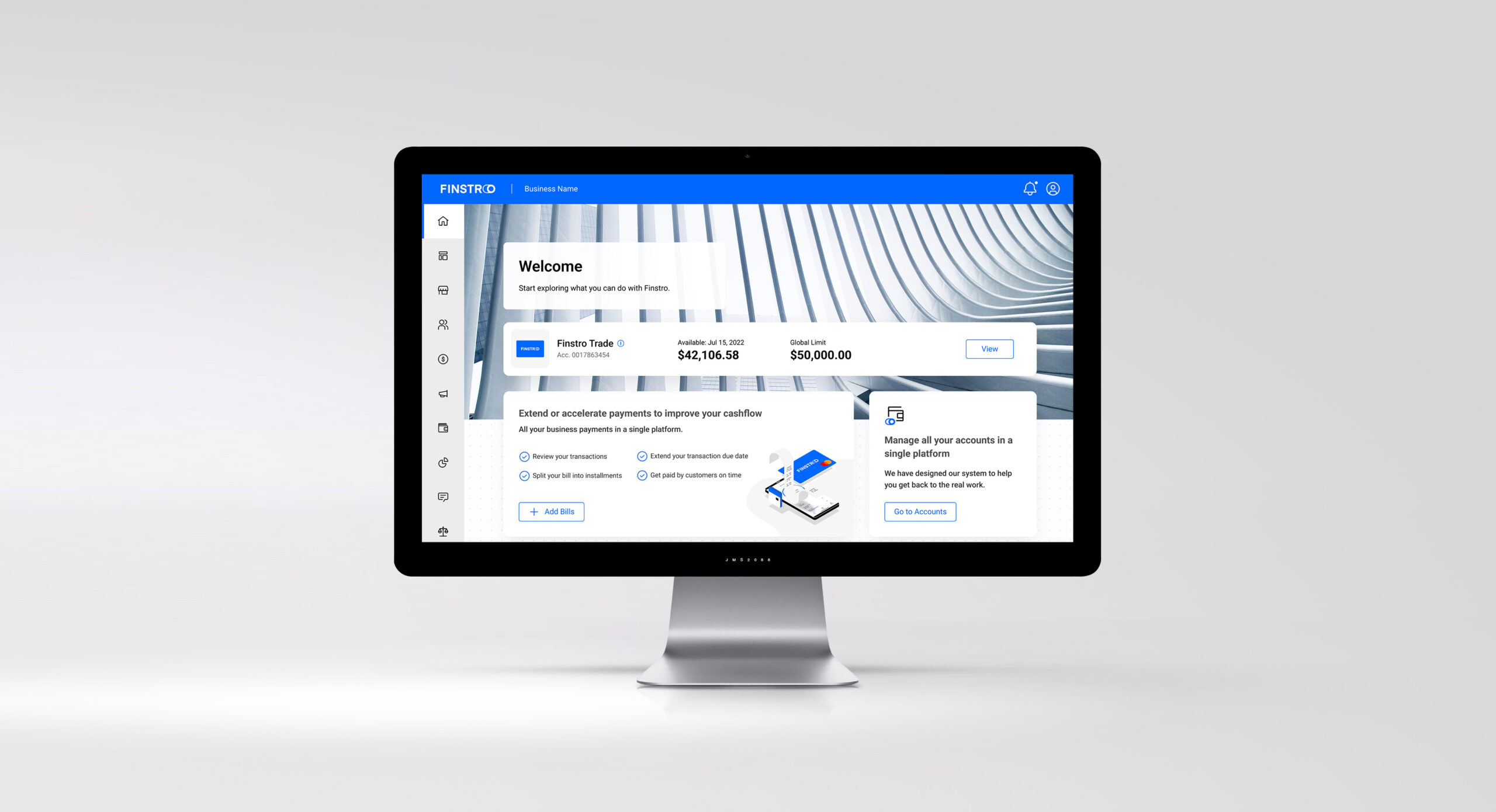

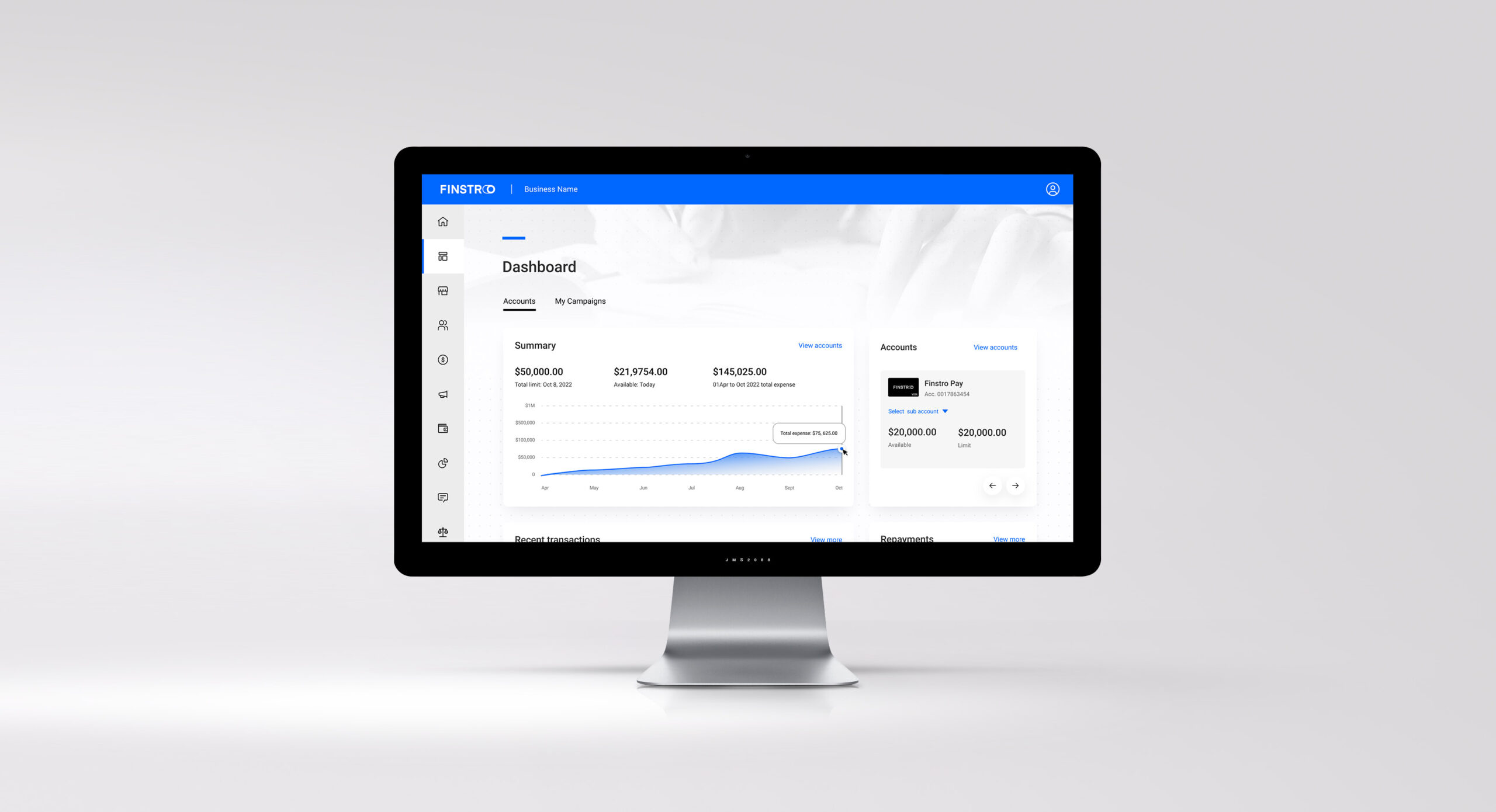

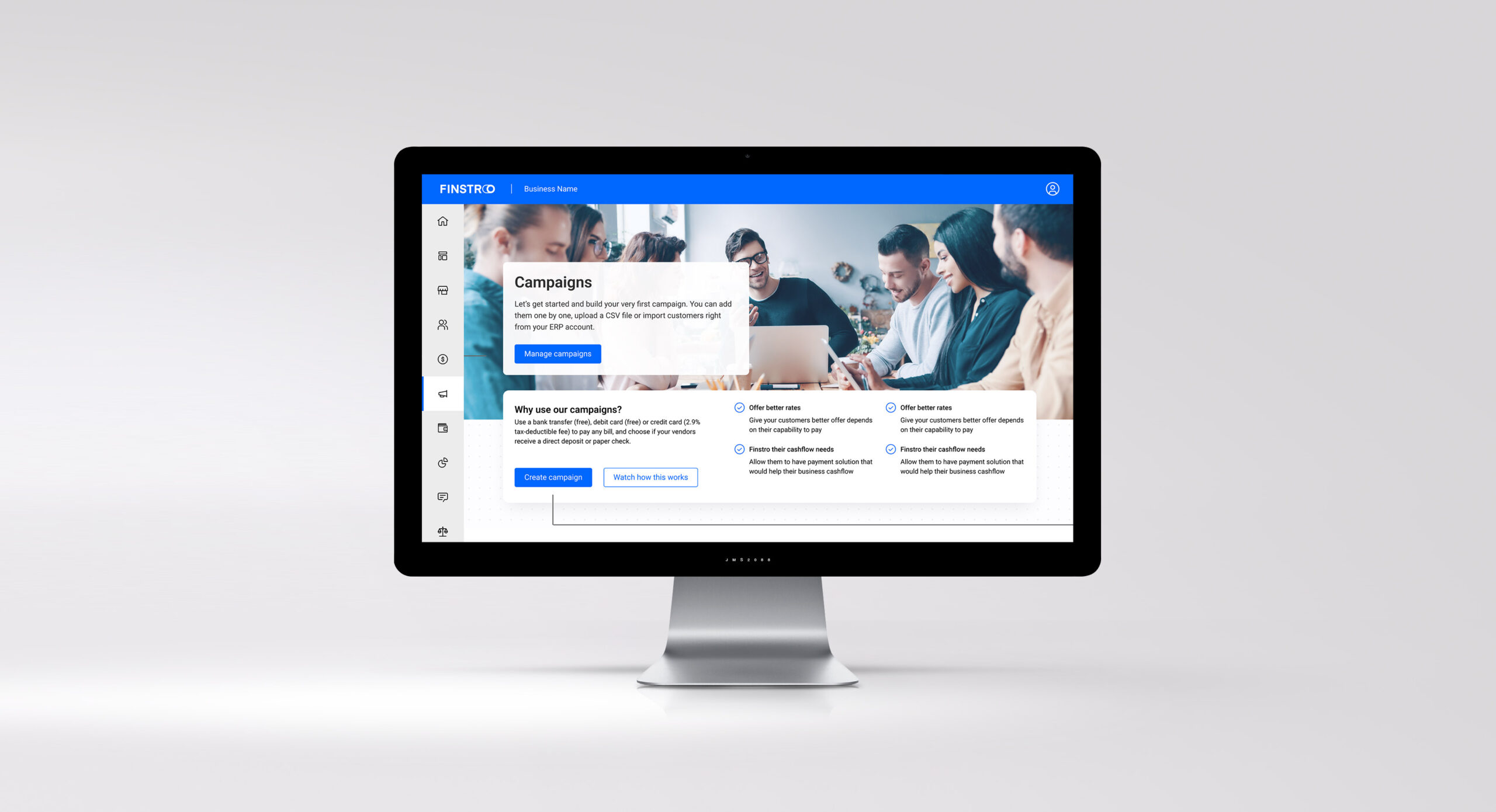

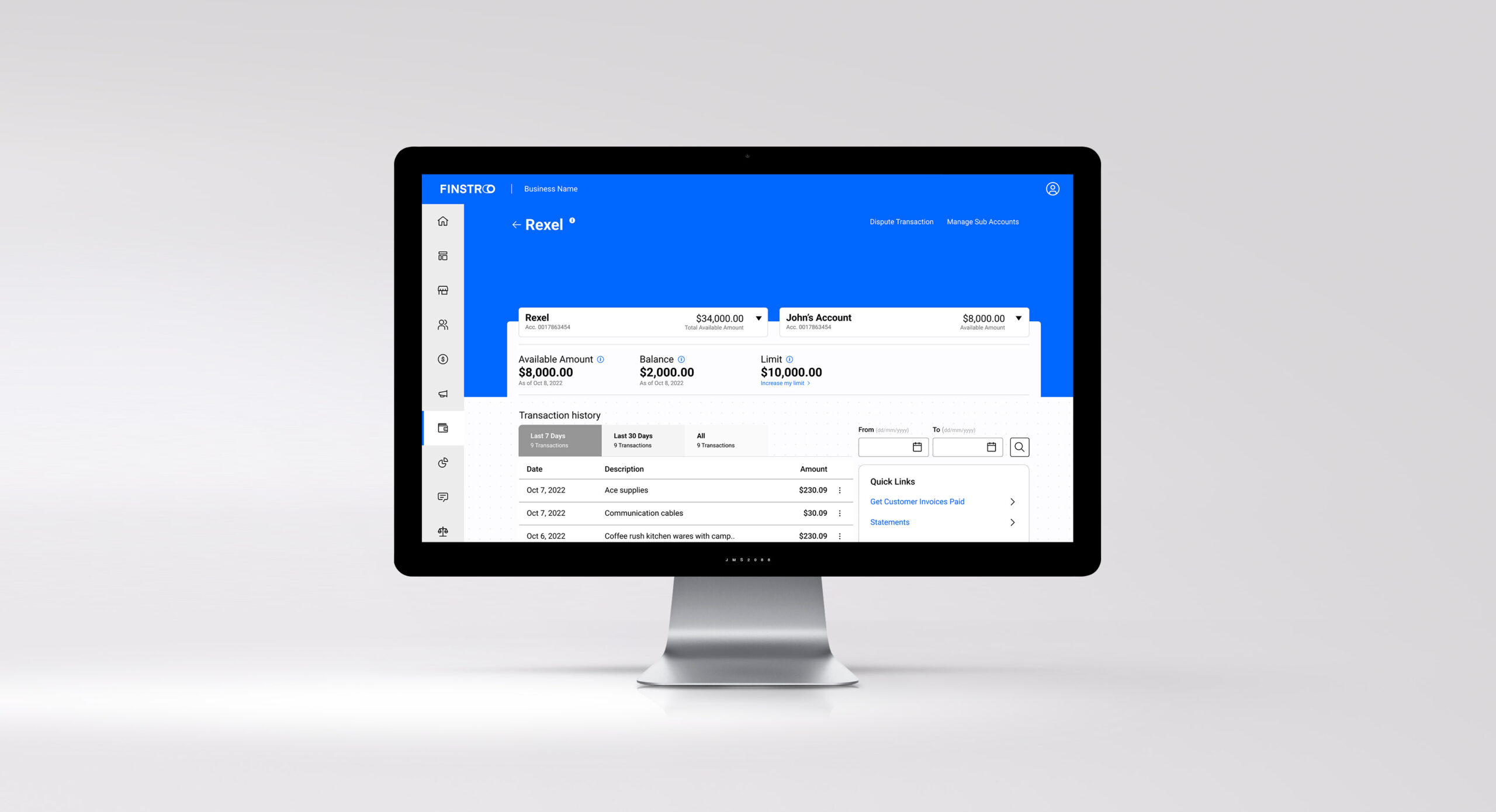

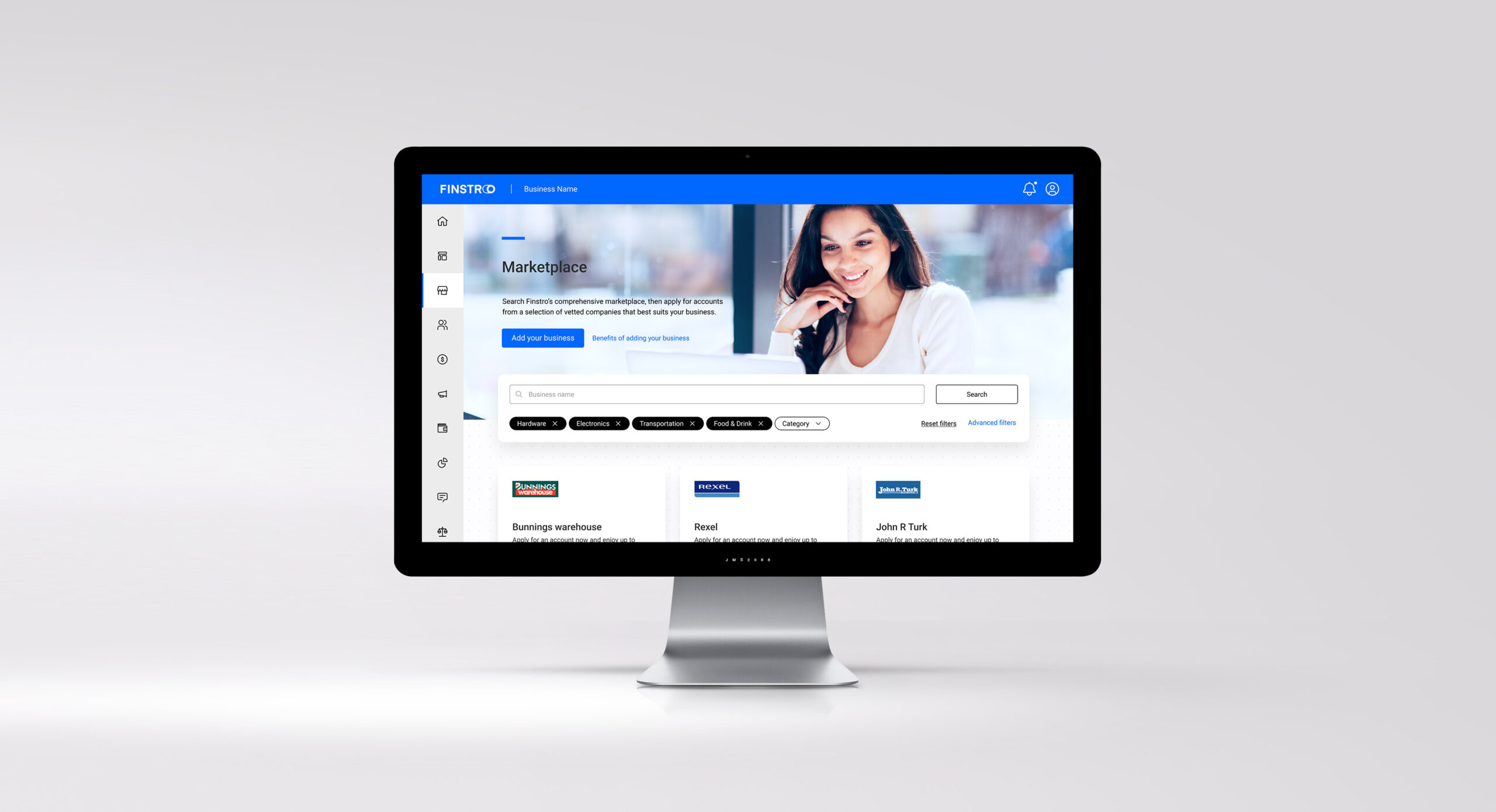

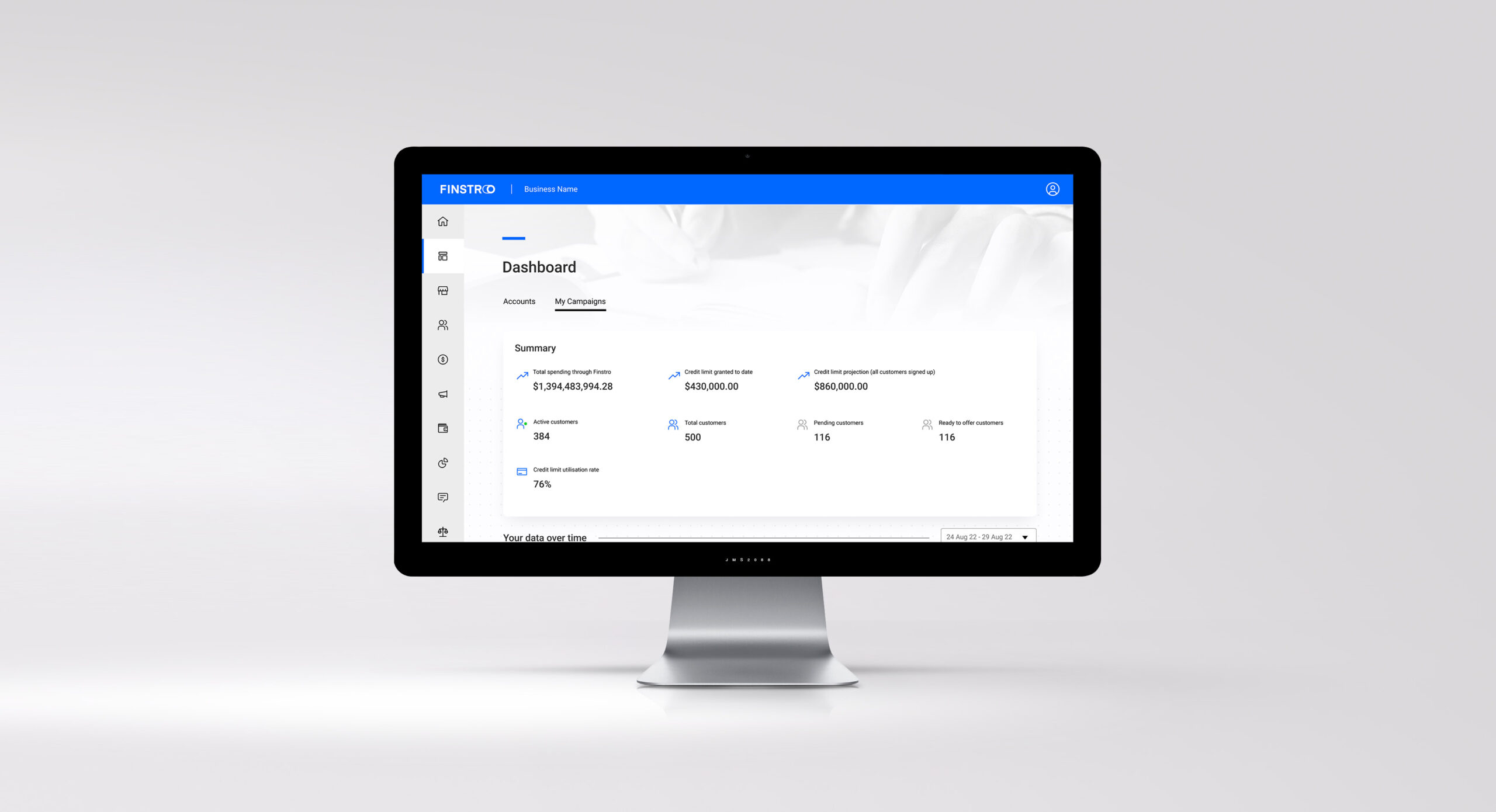

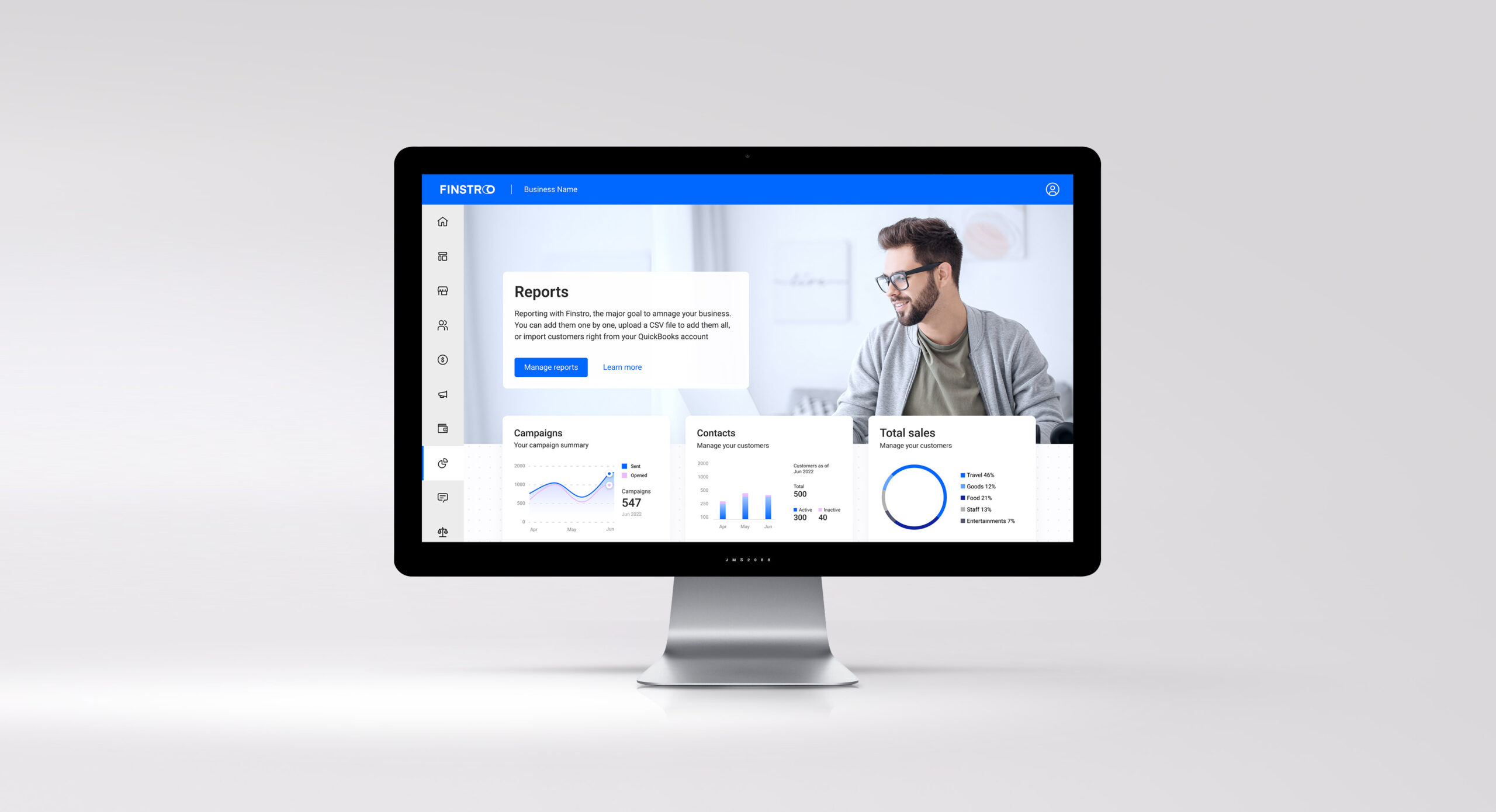

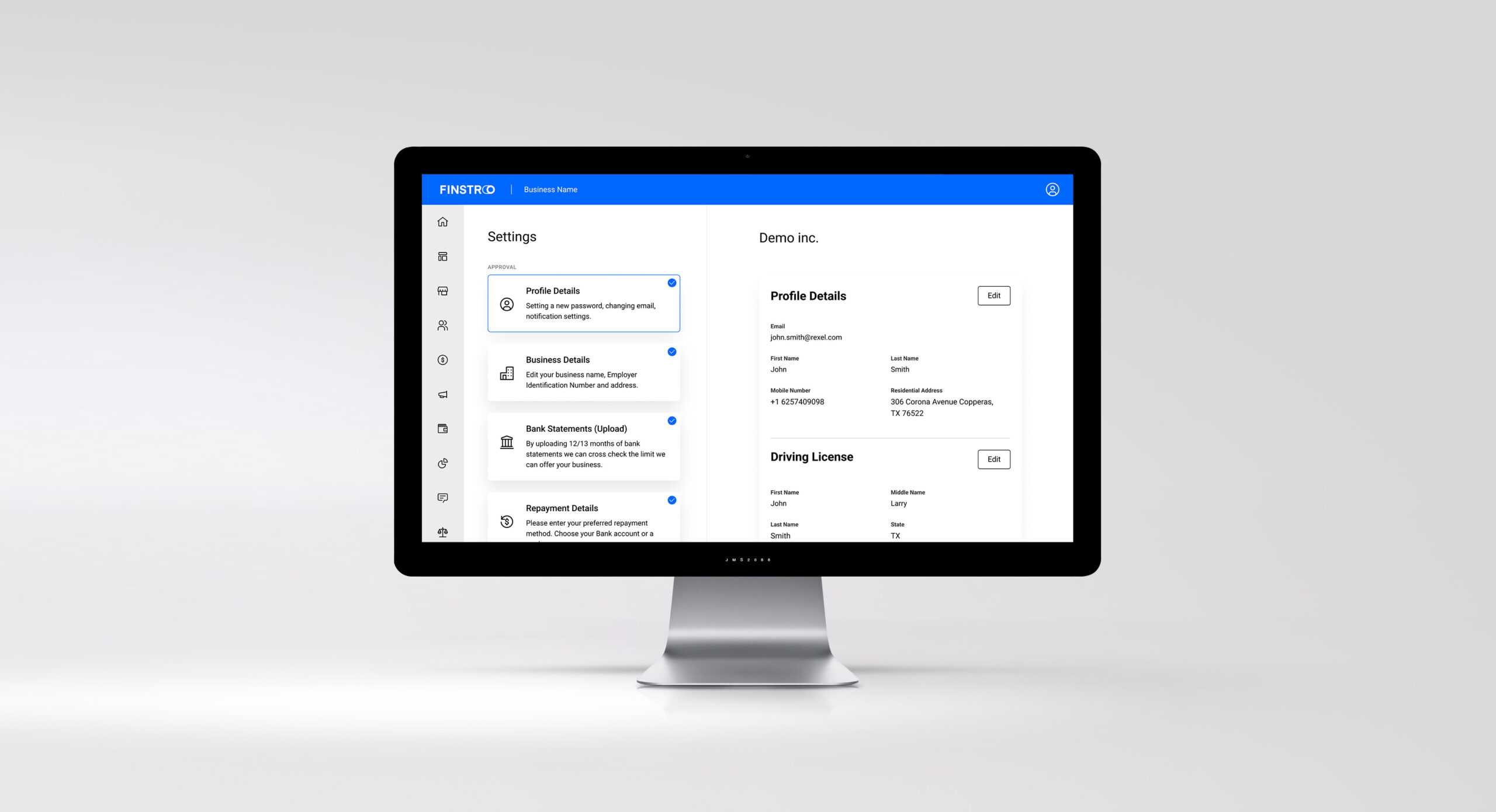

Brandlab’s design team crafted an intuitive interface for the front-office module, ensuring users could effortlessly navigate features like client management, transaction tracking, and customer onboarding. Meanwhile, the back-office module was developed to optimize operational workflows, including automated reconciliation, data analytics, and compliance reporting. The result was a unified platform that bridged the gap between customer-facing services and internal operations.

Development and Testing

- Developed the backend using Node.js for scalability.

- Frontend created with React for dynamic user interactions.

- Integrated APIs for third-party services, including payment gateways and accounting tools.

Testing:

- Conducted extensive testing across multiple stages:

- Unit Testing: Verified individual components, such as invoice generation.

- Integration Testing: Ensured smooth communication between modules.

- User Acceptance Testing (UAT): Worked with beta testers to fine-tune features.

- Unit Testing: Verified individual components, such as invoice generation.

Deployment

- Phased rollout to ensure seamless adoption:

- Initial deployment to a pilot group of 50 businesses.

- Gradual scaling based on feedback.

- Initial deployment to a pilot group of 50 businesses.

- Provided training sessions and a dedicated support team to assist clients during the transition.

Quantitative Results

- Reduction in Delayed Payments: Overdue invoices decreased by 40% within six months.

- Efficiency Gains: Automation reduced invoice processing time by 60%.

- Cash Flow Visibility: Forecast accuracy improved by 85%.

Qualitative Feedback

- From Users: “The dynamic payment terms feature is a game-changer for our clients.”

- From Internal Teams: “Integration with our ERP system was seamless, reducing manual errors significantly.”

Technology Stack

The experienced increased customer engagement, a boost in sales, and a stronger brand presence in the market.

- Frontend: Angual.js for dynamic and responsive user interfaces.

- Backend: C, C# .net JAVA and areas of Python for robust transaction, with GraphQL for efficient data querying.

- Cloud Services: AWS scalable hosting and storage.

- Data Analytics: Elasticsearch and Kibana for real-time user behaviour insights.

Marketing Strategy

By leveraging cloud technology, Brandlab ensured the platform was scalable and resilient, capable of handling increased transaction volumes as the client expanded their business. Advanced data encryption and compliance protocols were incorporated to meet global banking and financial regulations, instilling confidence in both the client and their end-users.

Throughout the project, Brandlab maintained a focus on delivering not just a product, but a comprehensive solution that empowered the client to streamline operations, enhance customer satisfaction, and achieve new levels of operational excellence. By marrying innovation with practicality, Brandlab’s involvement resulted in a SaaS platform that set new industry benchmarks and positioned the client as a leader in their field.

Qualitative Feedback

- From Users: “The dynamic payment terms feature is a game-changer for our clients.”

- From Internal Teams: “Integration with our ERP system was seamless, reducing manual errors significantly.”

Key Learnings and Recommendations

- Early Stakeholder Involvement: Including end-users in the design phase ensured the solution met real-world needs.

- Data-Driven Decisions: Leveraging AI for forecasting added immense value, showcasing the power of predictive analytics.

- Iterative Development: Adopting an agile approach allowed for continuous improvement based on client feedback.

Future Enhancements

- AI-Powered Insights: Enhance forecasting by integrating machine learning models that factor in external variables like market trends and economic shifts.

- Global Expansion: Add multi-currency support to serve international B2B clients.

- Blockchain Integration: Explore blockchain technology for enhanced payment security and transparency.

We are redefining excellence in technology. shaping tomorrow's open Ai.

We are redefining excellence in technology. shaping tomorrow's open Ai.